child tax credit october payments

Governor Dan McKee announced earlier this month that eligible families will receive 250 per child for up to three children. The overall monthly child poverty rate decreased between September and October from 132 percent to 128 percent.

Child Tax Credit First October Payments Coming Tomorrow Marca

Includes related provincial and territorial programs.

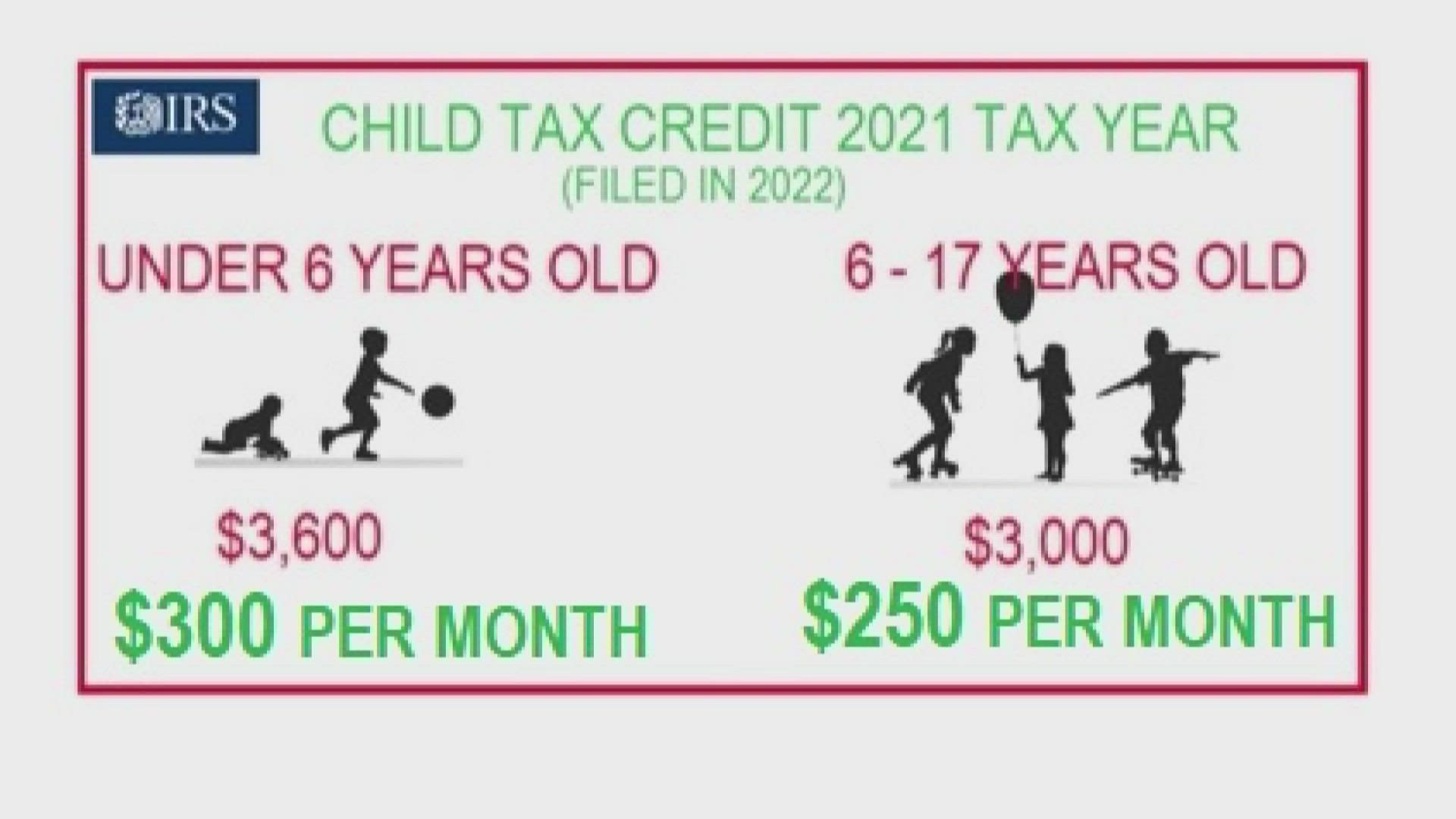

. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October. Some late claimers might get 600 in October and the.

According to NBC anyone hoping to be eligible for. Checks will be distributed automatically. Goods and services tax harmonized sales tax GSTHST credit.

The Child Tax Credits CTC are set to revert to. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors.

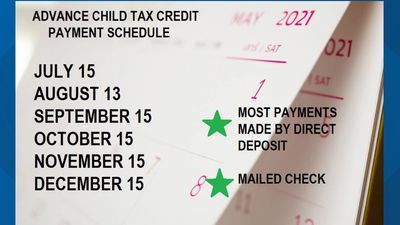

Child Tax Credit 2022 3 payments each worth 250 going out this month. Next payment coming on October 15. Wait 5 working days from the payment date to contact us.

The payments for Rhode Islanders come in the form of child tax rebates with a minimum payment of 250 for each eligible child and a maximum of three children totaling. October 4 2022 Elijah Lucas Stimulus Check 0. Continuing forms of COVID-19 economic relief including.

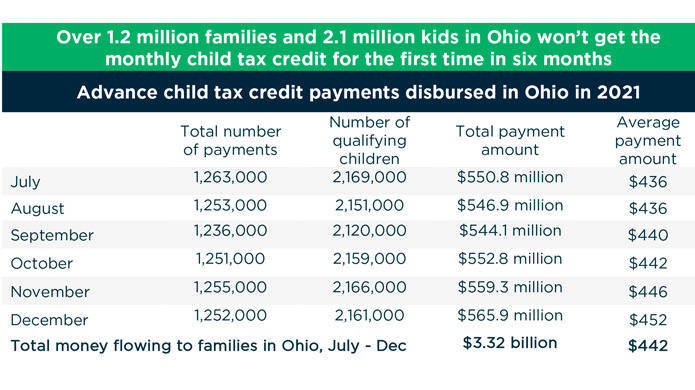

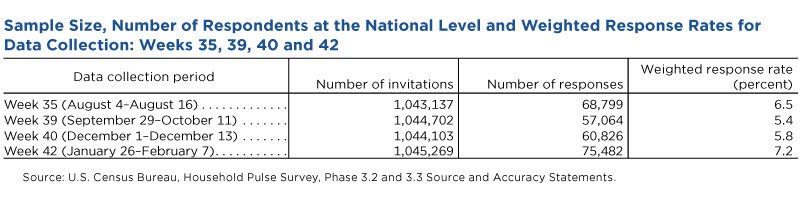

Have been a US. Starting with the October payments the individuals who received those payments approximately 220 000 people will stop receiving payments. 8 2022 300 am.

For qualifying children claimed. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments. Supplemental Security Income Benefits.

Under the American Rescue Plan each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. New Yorkers who received the Empire State Child Credit andor the Earned Income Credit on their 2021 state tax returns are eligible for the new stimulus check. Residents who received at least 100 in 2021 from an Empire State child credit or income credit and filed their state income tax return.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. Previously there was a flat rate of 2000 dollars a year until a childs 17th birthday but the new system has added a year of eligibility in the and upped the maximum rate for all. IR-2021-201 October 15 2021.

In 2020 and earlier years it was a credit of up to 2000 per child and was claimed on your tax return. The child tax credit scheme was expanded to 3600 from 2000 earlier this. Child tax credit payments worth up to 300 will be deposited from October 15 Credit.

Thanks to the Child Tax Credit from the previous year parents who have low incomes can still get almost 10000 dollars. The actual time the check arrives depends. CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15.

Rhode Islands CTC scheduled for October. The child tax credits are a part of the American Rescue Plan which was signed into law by President Joe Biden in March. Everything you need to know.

California Hawaii Indiana and Virginia are among the states sending out tax rebate checks this month. Child Tax Credit Dates. Users will need a copy of their 2020 tax return or.

The Child Tax Credit underwent a significant change in 2021.

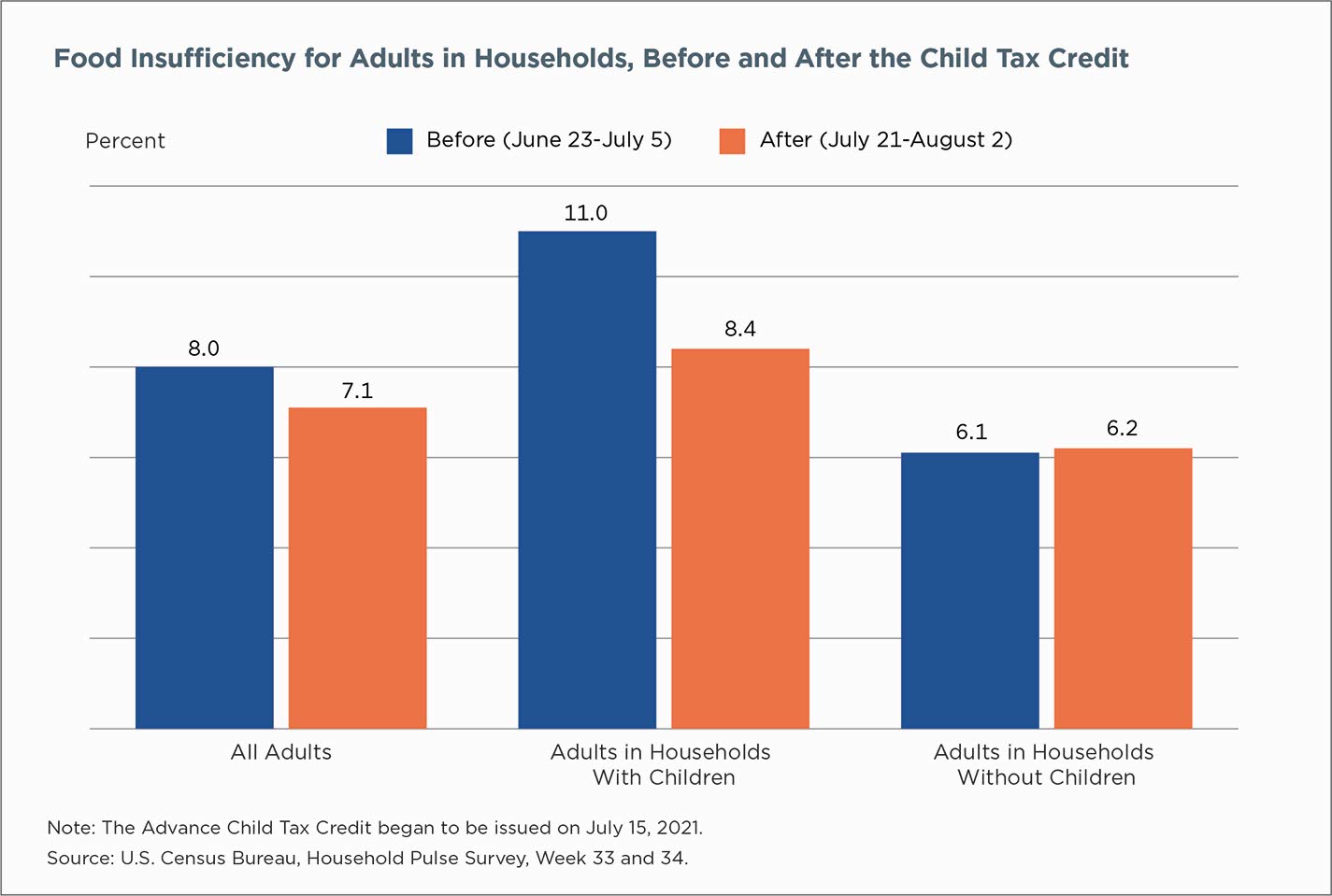

Families Saw Less Economic Hardship As Child Tax Credit Payments Came

Child Tax Credit Payments To Begin July 15 Sciarabba Walker Co Llp

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Eligible Families Can Expect Child Tax Credit Payments For October

Child Tax Credits When Is The October Payment And What Is The Deadline To Unenroll From Monthly Payments

Child Tax Credit 2022 How Much Money Could You Get From Your State Cnet

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com

Stimulus Update Some Child Tax Credit Payments May Be Lower In October November And December Al Com

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Harder To Pay The Bills Now That Child Tax Credit Payments Have Ended

What Families Need To Know About The Ctc In 2022 Clasp

October Child Tax Credit Payment U S Gov Connect

Child Tax Credit First October Payments Coming Tomorrow Marca

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Expanded Child Tax Credit Contains Almost No Tax Cuts American Enterprise Institute Aei

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Three More Advanced Child Tax Credit Payments To Hit Accounts Wfmynews2 Com

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase