tax strategies for high income earners canada

Max Out Your Retirement Account. Tax Tips For Earners In 2020 Loans Canada from loanscanadaca Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your.

Tax Strategies For High Income Earners 2022 Youtube

For example you could.

. An overview of the tax rules for high-income earners. Trusts can also help reduce your state income tax liability on investment earnings so while the Federal tax rate stays the same there are savings on state taxes. Total positive income is the sum of all.

As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs. While income splitting between family members may no longer be viable the new rules do not prevent higher income. Last week the Progressive Conservative government announced it would draw 70 million less in revenue thanks to income tax cuts for New Brunswickers earning more than.

As of 2020 you can contribute up to 3500 per year as an individual or up to 7100 on behalf of your family. Luckily there are many tax strategies and planning opportunities. Setting up a trust can be a great way to reduce your tax bill.

While this strategy is particularly effective for. If youre over 55 you can. Dont discount the wealth-generating potential and flexibility an HSA can afford.

The good news is that there are numerous tax-reduction techniques available for high-income taxpayers if you happen to be in the higher tax bracket. Everyday tax strategies for Canadians. The IRS defines a high-income earner as any taxpayer who reports 200000 or more in total positive income TPI on their tax return.

Discretionary trusts allow you the opportunity to distribute income to lower tax-paying. Tax Planning for High Income Canadians. 5 things to get right.

First a property with a good location may appreciate in value through time resulting in a capital appreciation. Utilize RRSPs TFSAs RESPs to the max. You must however be.

We will begin by looking at the tax laws applicable to high-income earners. Tax Planning Strategies For Canadians from wwwkewcorpca. This article highlights a non-exhaustive list of tax.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Income splitting is another favourite Canadian tax saving strategy among high-income households. With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self-employed.

All contributions that you make are tax-deductible. This is especially true for high-income individuals as they are generally subject to much higher tax rates than most people. We will also answer questions such as How do high-income earners reduce taxes What income levels pay the most taxes and Why are billionaires not taxed 5.

High-income earners make 170050 per. Second the yearly loss is typically compensable by other. This is an important strategy.

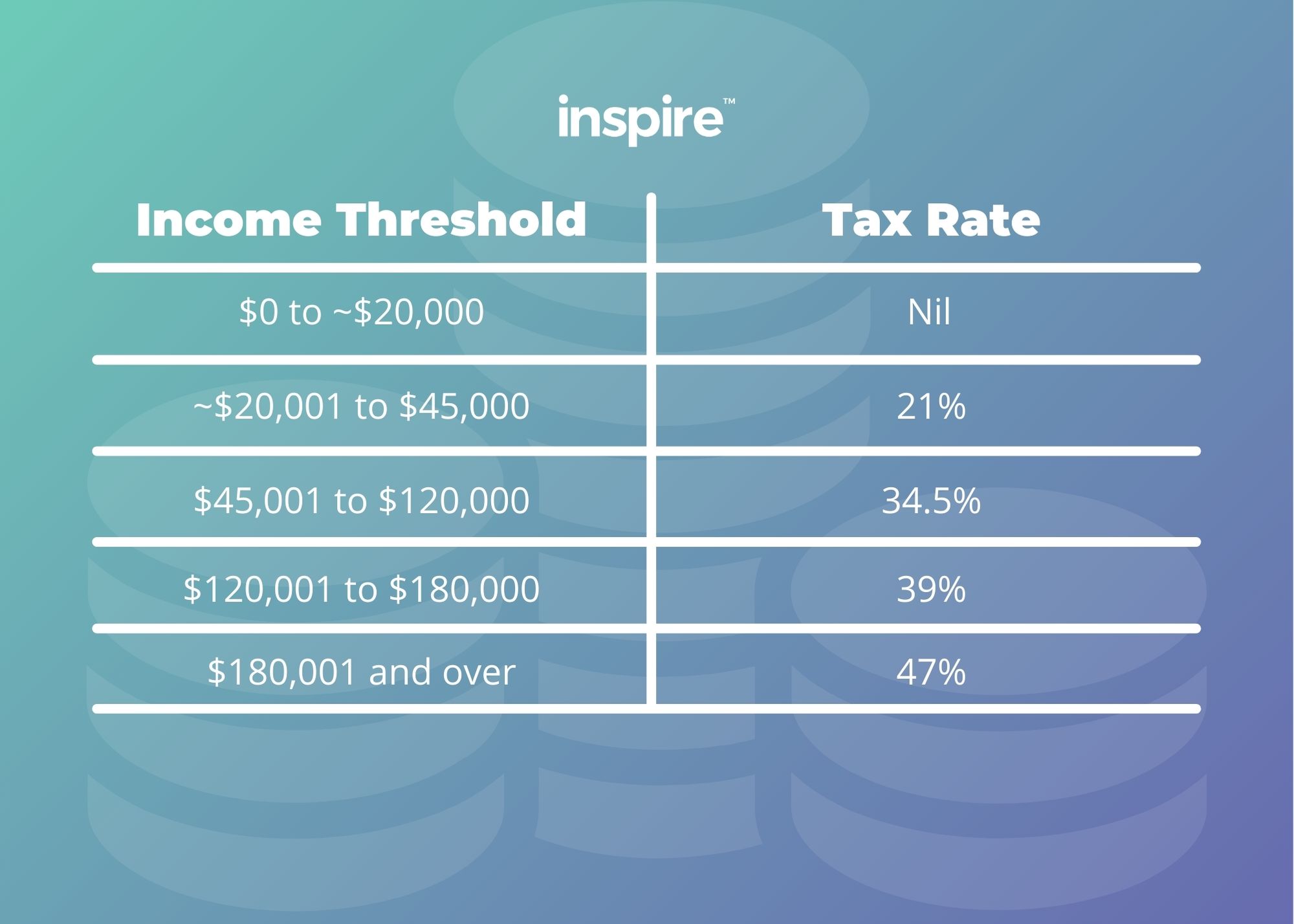

Chen says one of the main components of tax strategy is to utilize tax-deferred or tax. Wealthy canadians use these accounts too though jamie golombek managing director of tax. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000.

So you have to decide if its worth spending that for the other tax benefits Income-splitting and prescribed rate loans. It involves redirecting your income within the household.

Tax Minimisation Strategies For High Income Earners

Everyday Tax Strategies For Canadians Td Wealth

Income Inequality Our World In Data

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Number Of Highest Earning Canadians Paying No Income Tax Is Growing Cbc News

How To Reduce Taxes For High Income Earners In Canada

Tax Planning Strategies For High Income Canadians

Scraping By On 500k A Year Why It S So Hard To Escape The Race

Tax Free Retirement Income Capital Accumulation Investments

5 Tax Strategies For High Income Earners Pillarwm

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

High Income Earners F I R E On Apple Podcasts

Advanced Tax Strategies For High Net Worth Individuals Moneytalk

:max_bytes(150000):strip_icc()/139467695-56a82eed3df78cf7729cdb3c.jpg)

Small Business Tax Strategies To Reduce Tax Canada

9 International Strategies For Tax Planning Gamburg Cpa

The Top 9 Tax Planning Strategies For High Income Employees Inspire Accountants Small Business Accountants Brisbane

![]()

How Do High Income Earners Reduce Taxes Legally Beyond Rrsp Tfsa Etc R Personalfinancecanada

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Tax Burden By Country How The Us Compares Internationally The Turbotax Blog